2018 signified a heightened investment in Financial Technology Start-Ups (FinTechs) in Nigeria and Africa. In that year, about $114 million was raised by technology companies in Nigeria, with 75% of this going to FinTech companies. Between 2014 and 2019, Nigeria’s fintech scene raised more than $600 million in funding, representing 25% ($122 million) of the $491.6 million raised by African tech startups in 2019.

The FinTech sector in Nigeria has experienced growth over the years due to increased investment, a rise in the adoption of digital technology by a young population, and the regulatory drive for financial inclusion.

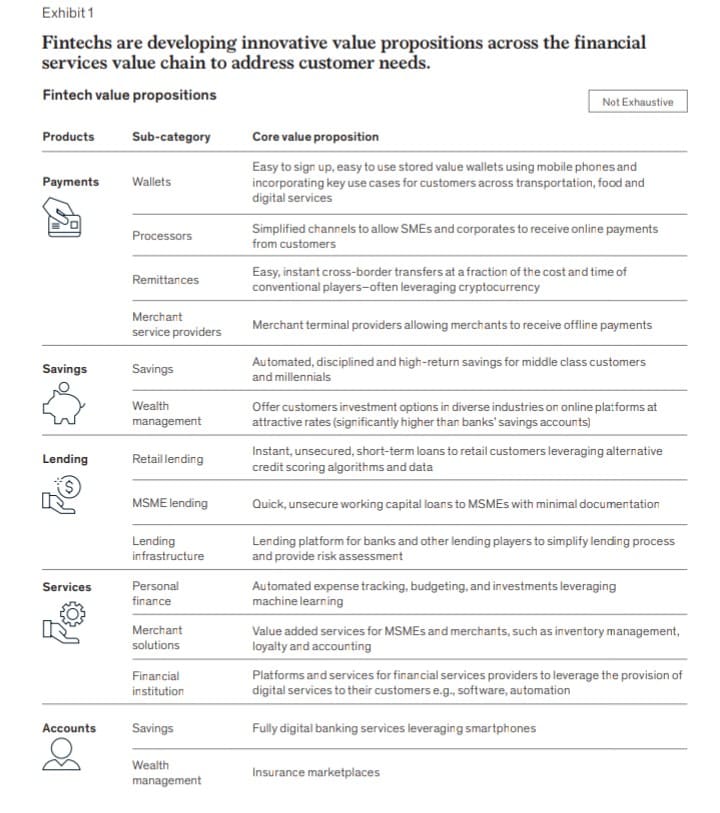

One of the unique characteristics of fintechs is that they are highly specialized. They focus on a single product or service and deliver top quality, lower costs, and an exceptional user experience through advanced technology that gives them a competitive advantage.

FinTechs have developed quality products across the value chain of the financial sector to address pain points in affordable payments, quick loans, flexible savings, and investments, among others.

Source: McKinsey Nigeria

Our focus on the value chain is one aspect of retail banking, savings deposits, an area where traditional banks have received increased competition from fintech startups. The major players in this space are PiggyVest and CowryWise. These fintechs are shaping the savings and investment culture among millennials and young professionals by offering easy-to-use digital platforms. Their products serve the same function as savings deposit accounts of traditional banks but with more attractive interest rates of 10–13% (now reduced to 8–11% due to rising inflation in Nigeria), compared to about 1.25–6% from traditional banks, which barely keep up with inflation.

A survey carried out among a group of people revealed the following: 85% of survey responses were from millennials aged 20 –29.

- 45.5% of respondents said their preferred mode of saving was through Fintech Apps.

- The remaining 48.5% was split between bank savings accounts, Ajo, and cooperative systems.

When asked why they preferred their preferred savings method, most respondents gave reasons such as ease of savings, reasonable interest payments, discipline and planning tools, low transaction costs, convenience, the ability to lock money without paperwork, and emergency withdrawals without bureaucracy.

Most respondents had an average of two (2) accounts.

When asked what they use their bank accounts for, most respondents stated that their savings account was mainly for withdrawing funds, sending and receiving money, making third-party transfers, online transactions, and expense payment.

From this data, some inferences can be drawn:

- Savings Deposit Accounts are no longer used for their original purpose—saving—but primarily as “holding accounts” for receiving funds and transactions.

- Data from three (3) major commercial banks in Nigeria support this conclusion. Looking at the financial statements of one of the oldest banks reveals that the contribution of fees and commission (F&C) income continues to dominate the non-interest revenue stream, contributing 65.5% and 70.2% in 2018 and 2019, respectively. The key drivers of F&C remained electronic banking fees and account maintenance fees, which grew 41.2% year-on-year (from ₦32.0bn in December 2018 to ₦48.0bn in December 2019) and 7.5% year-on-year (from ₦12.3bn in December 2018 to ₦34.0bn in December 2019).

- Also, in the maturity analysis of the financial liability of savings deposits contained in the financial statement of three (3) commercial banks, studies revealed that about 99.7% of savings deposits mature in less than three (3) months. This implies that most customers are not engaging in long-term savings with the Bank. This reduces the amount of deposit savings available for investment. However, banks benefit from increased non-interest income.

The gravitation toward fintech products and services is based on ease, simplicity, convenience, and specialization. This signals a change in the factors on which the financial sector competes on. A review of the savings products from most commercial banks reveals an assortment of offerings with minimal distinctive features. For instance, some commercial banks have a regular savings accounts, kiddies’ accounts, teens’ accounts, university student and NYSC corps member accounts, self-employed account, employee account, and promotional savings accounts. Despite these multiple products, a deposit savings account functions essentially the same: receiving and sending money. Some banks go further to provife various incentives for opening a savings account, like the chance to participate and win in a raffle draw or scholarship, but with the maturity analysis data, incentivizing for savings doesn’t appear effective.

Useful Insights and Recommendations

- Banks should redefine their retail deposit savings strategy by streamlining multiple product offerings into one major, easy-to-use, and convenient product that focuses on receiving, withdrawing, and sending money, while improving the efficiency and ease of their digital payment platforms to boost non-interest revenue.

- There is an opportunity for fintech companies like Kuda, Opay, and Alat, which focus on digital banking and provide seamless account opening processes, as well as easy transfers with little to no transaction charges. However, it is still uncertain whether low transaction costs alone will convert traditional bank users to these platforms. These digital banks must look for ways to expand their competitive advantage beyond what traditional banks offer.

- The influx of Fintechs and the digitization of financial services is rising rapidly. With COVID-19, more Nigerians are beginning to move to digitized products and services, which gives fintechs an edge with their use of advanced technology. Collaboration and partnerships are the best solutions for traditional banks threatened by these new entrants. Banks should reconsider their role in the industry, adopting a strategic position as suppliers or aggregators in the financial value chain in response to the shifts in the market. For instance, Providus Bank provides wholesale back-end solutions for several fintech players like Paystack.

Conclusion

McKinsey & Company, in their September publication, noted that Nigeria’s fintech landscape holds significant potential for exponential revenue growth. The pandemic has accelerated changes in consumer behavior, with fintechs well-positioned to fill the gaps left by traditional banks and to create products and services that add value to consumers, especially during this challenging time.

References

- A Guide to the Payment and FinTech Landscape in Nigeria: https://www.proshareng.com/news/Fintech/A-Guide-To-The-Payments-and-Fintech-Landscape-in-Nigeria/43313

- African Tech Startups Funding Report, Disrupt Africa, 2019

- McKinsey & Company, Harnessing Nigeria’s Fintech Potential: How Stakeholders Could Position the Fintech Sector for Growth Now and Beyond the Crisis, September 2020